"Progressive farmer" the target audience your agribusiness brand knows nothing about

By Saskia Krone

For as long as marketeers have been writing campaign briefs within the agribusiness sector, one phrase has repeated time and again. When teams are asked “who do you want to target your product at? Who do you want to communicate with?” the answer is usually “progressive farmers.”

‘Progressive farmers’ is a catch-all phrase for growers who are prepared to spend money and are actively engaging with ag media. On paper, progressives are the ideal target for anything from fungicide to foot rot vaccines. But when the marketing strategist digs deeper and asks for more detail about the progressive audience to try and find further insight on which to base a campaign, detail can be light.

Without further insight on personality traits and drivers, it is difficult to reach, engage, nurture, and activate a target farmer. Perhaps this is why, when a reader flicks though an agribusiness magazine, many of the adverts and messages are incredibly similar. Are all marketing teams trying to talk to ‘progressive farmers’ with little data behind their campaigns? Is there insight out there that teams can plug into to activate different types of farmers? And what does progressive mean anyway?

Does a progressive farmer exist?

Arguably, all farmers are progressive. Every farmer wants to improve their bottom line, reduce workload, increase quality and quantity of whatever they happen to grow. From an 80-year-old third generation on a mixed farm in the UK, to a 25-year-old new entrant managing tens of thousands of hectares with smart farming technologies in Australia, there is a commonality of desire to do well despite the challenges of weather, price and time. What farmers are less likely to do is to self-reflect on their motivations for their own behavior. Not in terms of practical, external behaviors on the farm – we know that they know they need to prepare seed beds meticulously, or that lameness in cows will directly impact milk yield - but the subconscious patterns and preferences that display externally as decision-making behaviors. It is these subconscious patterns that your marketing team want to understand, because farmers already know more than you ever will about how to get the best out of their own ground. Marketing teams therefore should not be advising on the practicalities of farming to capture attention, that level of education can come later, but to seize interest quickly by appealing to the subconscious motivations and personality of the farmer to shape decision making.

Without further insight on personality traits and drivers, it is difficult to reach, engage, nurture, and activate a target farmer. Perhaps this is why, when a reader flicks though an agribusiness magazine, many of the adverts and messages are incredibly similar. Are all marketing teams trying to talk to ‘progressive farmers’ with little data behind their campaigns? Is there insight out there that teams can plug into to activate different types of farmers? And what does progressive mean anyway?

Farmers are people, and people have personalities

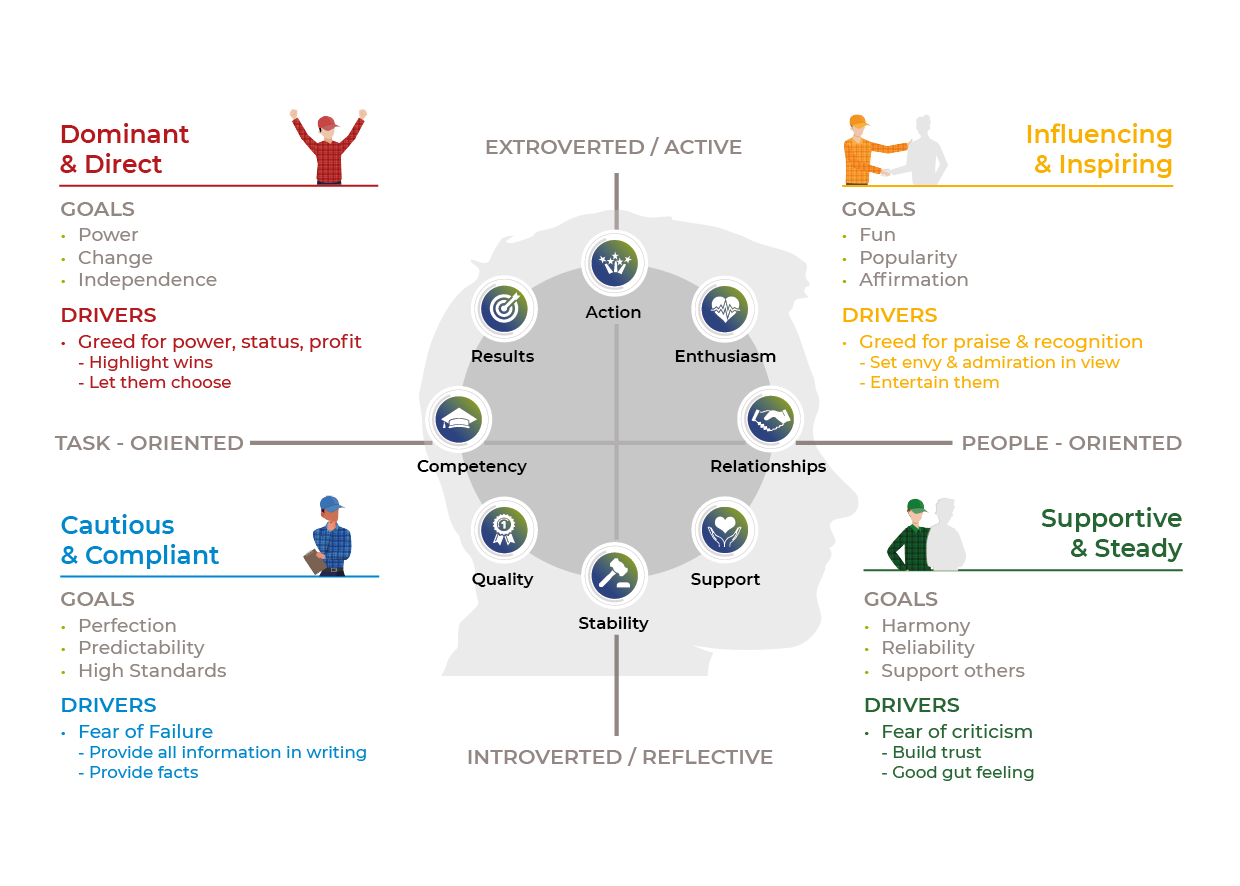

Personality profiling is long established. From Hippocrates in 400BC, to Jung in 1921 and even modern-day TED Talks, we’ve been able to define personality types in remarkably similar ways that have hardly changed over thousands of years. And yes, humans really are that easy to figure out. We all have characteristics, preferences, and needs and we all lead with one of four styles.

Blue

(Cautious & Compliant)

Introversion and Thinking: task focused, calm under pressure, thoughtful and objective.

Red

(Dominant & Direct)

Extraversion and Thinking: High activity, working with others, being logical and focusing on facts.

Green

(Supportive & Steady)

Introversion and Feeling: An approach favoring depth, reflection, harmony and consensus.

Yellow

(Influencing & Inspiring)

Extraversion and Feeling: Couples sociability and consideration for others with action-orientation and entertaining.

Farmers want to be communicated with in the way that suits them best

With the adage “people like people like them”, to attract attention and connect with your audience, it’s important to know what the farmer likes are by segment, and what makes them tick.

The farmer segmentation model employed by Kynetec is based on the deep understanding that every farmer wants to be communicated with in the way that suits them best. By aligning with preferences, marketing teams can activate a farmers’ decision drivers on a subconscious level. And ultimately what does that mean? Increased ROI on your sales and marketing efforts. It costs less to target accurately and achieve sales in a way that can be predicted.

For example, if your marketing team gets a brief to run a campaign to promote wheat seed in South Africa, and you know (thanks to Kynetec’s Segmenta product) that in that market the majority of farmers identify as Red, or Dominant & Direct, your headline would be very different than if you were promoting to Blue, or Cautious & Compliant farmers.

A Red headline could be:

“You’ll lead the way with Wheat Seed”

Whereas Blue targets are more likely to resonate with:

“Plan for optimal growth with Wheat Seed”

Using personality insight is the biggest opportunity for marketing success in 2024

Ag brands can also reverse-test their brand values using Segmenta technology. By looking at what colors make up the majority of their customer base, brands can review if this aligns with their messaging and visual style. From a growth perspective, this can be incredibly helpful when brands launch new products, not least in the crop protection space where the development of actives is both expensive and time consuming. By understanding if their current customers have the appetite for an “Exciting! New! Increased Yield!” message favored by Red and Yellow, over a “Comprehensive Trial Results” view preferred by Blues and Greens, a brand can make or break the success of a new product launch. Similarly, there are examples within the Segmenta data specific to market and crop that shows there is scope to significantly increase, or even double market penetration and/or share for certain well-known brands simply having a growth strategy that targets their smallest color audience better.

Media selection can be inferred by color preference

Quite often the main budget restriction for marketing teams is media spend, demonstrably the gateway to connection with prospects. While CRM and meticulous customer journeys based on color preference is the optimal way to nurture current customers and prospects, Segmenta data shows us that for many brands, they are a little way ‘off’ in attracting the right color for their product offering.

Understanding that extraverted Yellows appreciate the sales team checking in, and ideally visiting with a free hat and poster for the children, in comparison to introverted Blues who would like a very detailed brochure of all trial data sent in the post, shows how far apart they are on the spectrum of contact approach. Greens will make a decision to reduce risk having read an article about a neighboring farmer who couldn’t get hold of spring seed following a wet fall, but not until they have spoken to a family member first. Reds want to be involved in your trials and will often tell you what they project to be their biggest challenges over the next five years, because they plan ahead and execute.

Media planning can be an expensive undertaking, particularly when brands attend international shows, advertise in print and online, print brochures and other collateral and run a CRM system. Nevertheless, these are all valid touchpoints for progressive farmers – it simply depends on which color you need to target based on who your brand already has as customers. Once a brand knows which color to target, the marketing department can be given a brief to target “Greens, OSR, in France” and be off to a flying, and more ROI effective, start.

Naturally, there will also be campaigns that require all colors to be made aware of a particular product or service, for example content around sustainability. In that instance, using an approach such as the below, when you have a view of the color splits in the market you want to capture.

Which color is a progressive farmer?

Reading through the descriptions of color types, marketing teams often land on Red as being the most important, or ‘progressive’ farmers because of their propensity to make quick decisions and embrace technology. In reality, all farmers making a profit are progressive.

When it comes to marketing specifically, Kynetec believes ‘progressive’ is too general a description of a group of farmers to create meaningful insights to successfully position a product. Our advice to brands is to target farmers by color preference using Segmenta, allowing deeper understanding of farmer needs, and how to meet them.

Segmenta data reveals that the split between color preferences overall in farmers in the US and Canada, France, UK, Germany Belgium, Netherlands, Portugal, Spain, Czech Republic is fairly equal. But South Africa, Italy and Serbia are weighted towards one color. Brands can also benefit from Segmenta analysis of their current customer structure, to help set clear targets and concrete strategies to achieve them.

Saskia Krone

Innovation Director, Global Customer Insights Practice