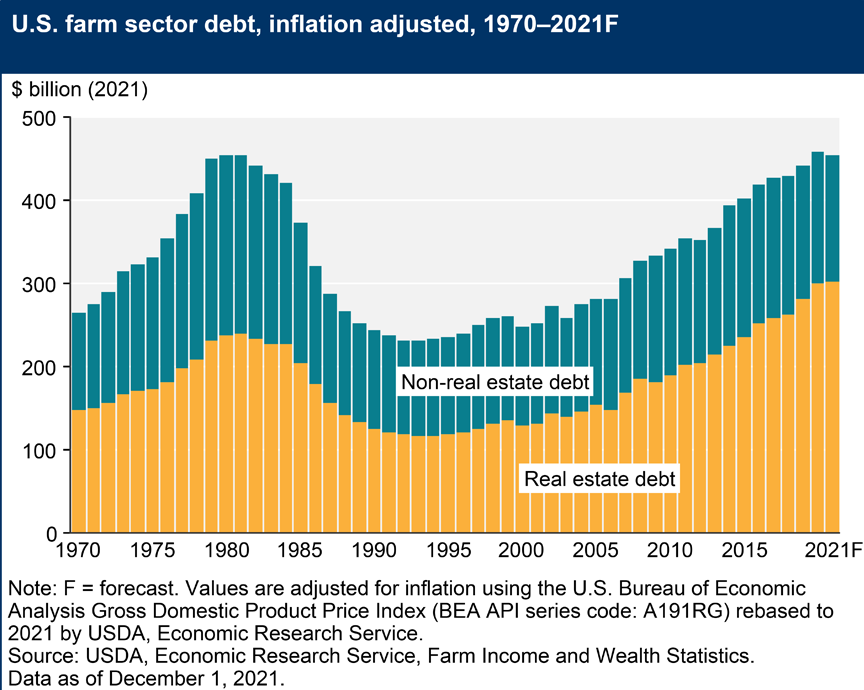

As US Central Banks telegraph raising interest rates to fight inflation, farm debt nears all-time highs

In a pattern similar to the late 1970s, US farm debt has reached record levels going into a potential interest rate raising cycle to fight inflation

What impact will raising interest rates have on the farm economy and farmland prices with debt levels at record highs?

For credit markets to function, interest rates need to be higher than the rate of inflation so as not to disincentivize lending. If interest rates come down or reduce after an attempted rise, inflation could increase and send commodity prices higher.

If inflation rates are higher than interest rates, financial institutions have a negative incentive to lend, and financing conditions can tighten due to effective negative interest rates while the rate is still nominally positive. For example, if interest rates are 4% and the inflation rate is 7%, then in real terms the interest rate is -3%, even though the nominal interest rate is +4%.

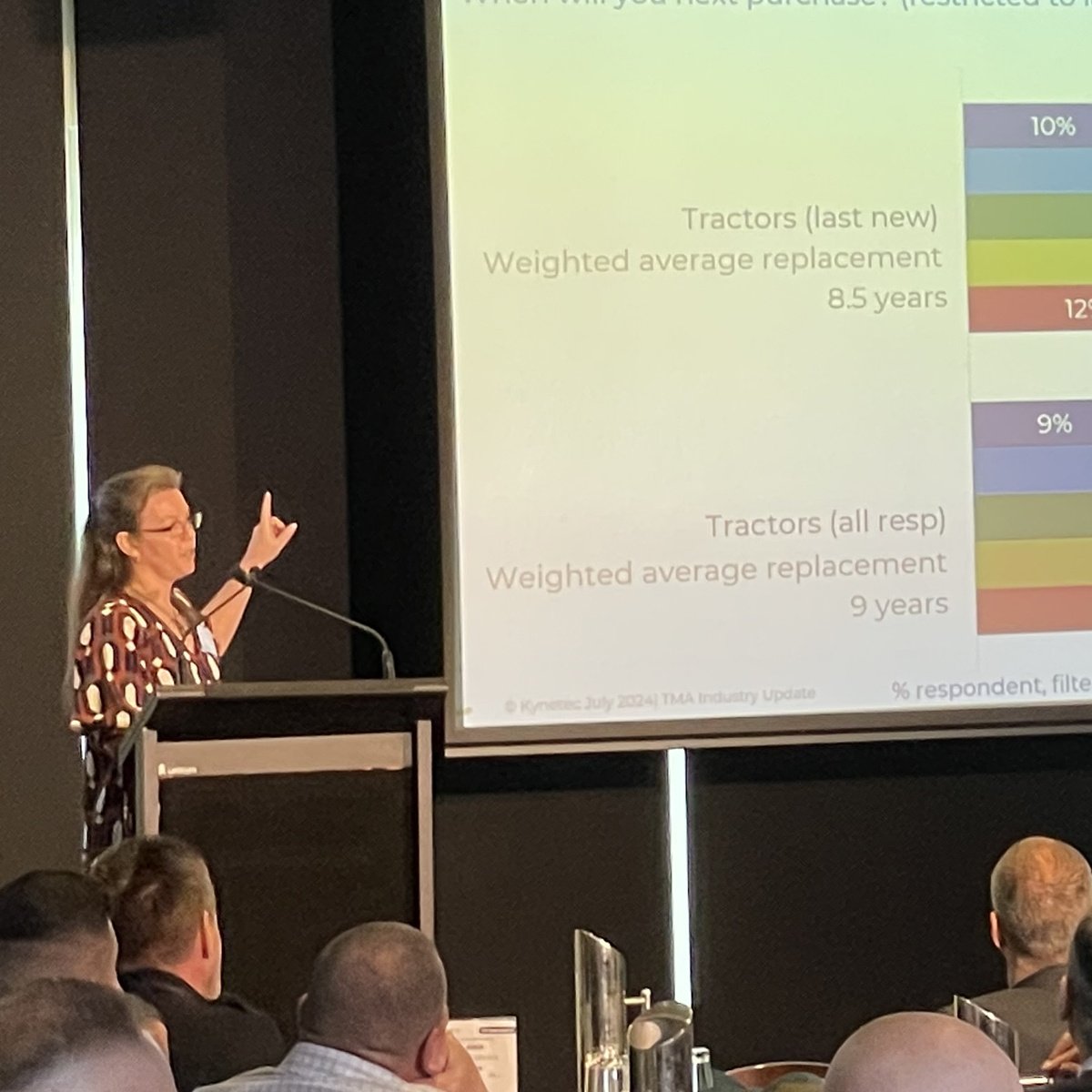

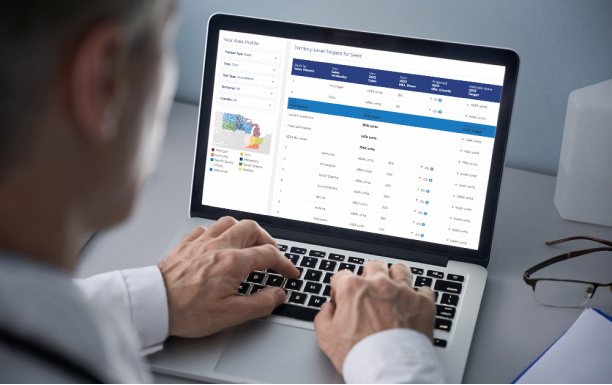

Kynetec’s Advanced Analytics team is tracking this situation and simulating different economic scenarios to understand their impacts on the farm economy. What impact will this situation have on your organization? Reach out with your own research questions and let’s unlock the insights in your data.

Kynetec owns the largest global ag database in the world with over 30 years of proprietary data and billions of data.

News

The latest from Kynetec