The World and European Seed Market – a sneak preview from new data collection and analysis

Dr Nomman Ahmed opened the Section Forage and Grasses at Euroseeds 2023. Recognized as the leading global seed event, Euroseeds was held in Malta from the 15th to the 18th October 2023.

Dr Ahmed, Executive Director of Global Trend Research & Analytics at Kynetec, set the scene with global insights from agricultural market insights with data and trends globally. Global favorites, the “Top Five” – corn, wheat, soybeans, rice and barley – still account for 90% of global value and 85% of global cropping area. Despite challenges to the agricultural sector, Dr Ahmed was pleased to share a 5.1% YoY market growth in the seed market, with volume YoY growth marginal at 0.8%. Away from the Top Five, cropping area growth in harvest year ’22 was driven by soybeans, rapeseed and rice.

Europe booms in wheat and barley, pulls back on sugarbeet and corn

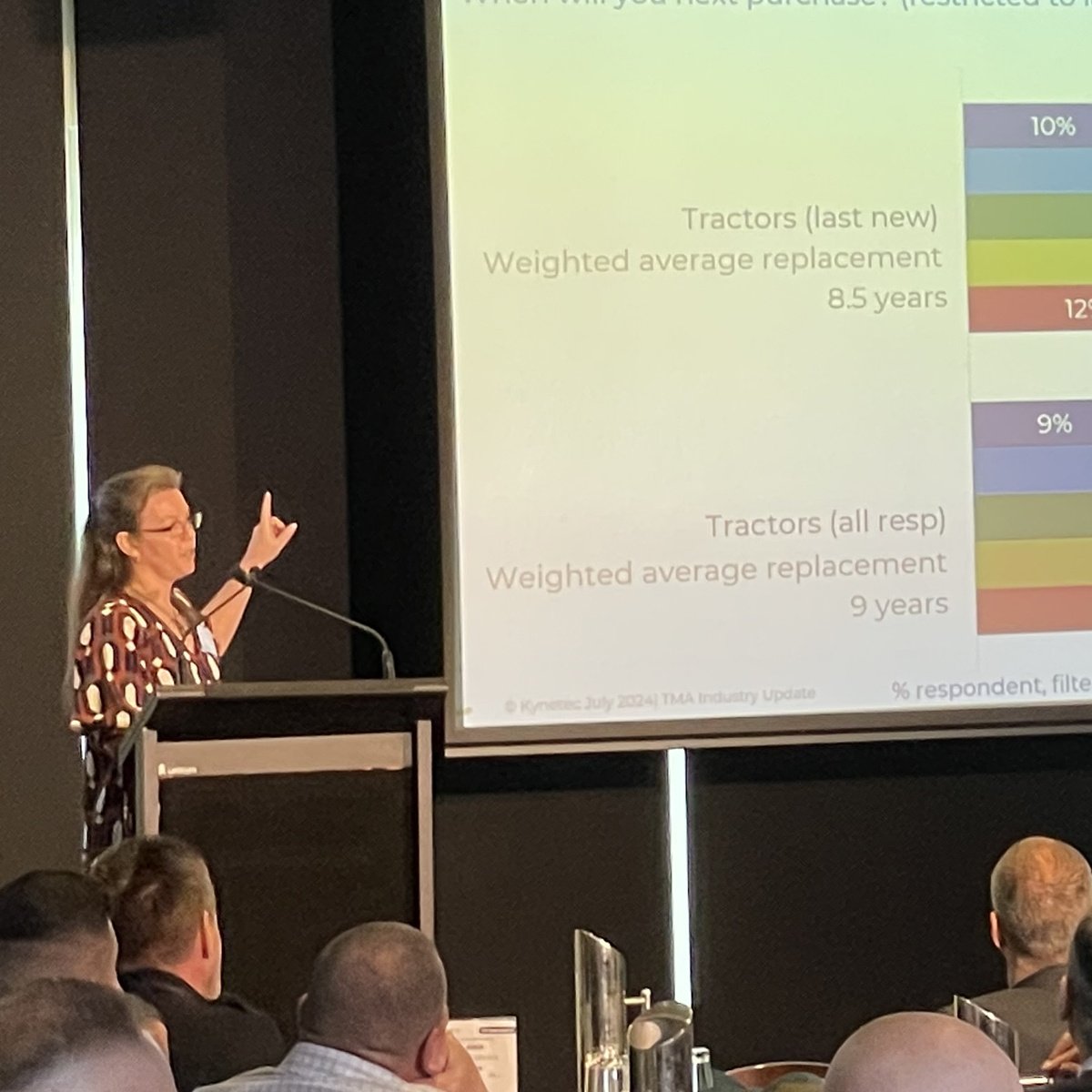

Following the global summary, Dr Ahmed got in-depth on the European harvest year 2022. Reporting on results identified in Kynetec’s cereal seed FarmTrak survey from circa 25,000 farms across Europe, the results showed an overall stable picture with grower behavior in seed remaining by and large unchallenged.

European growers are consistent with spring and winter cropping selections, with seed value growth driven by wheat, barley, rapeseed and sunflower. Negative growth was applicable to sugarbeet and corn; possibly driven by reduction in neonic use exemptions making growing more challenging and farmers opting for a safer crop to deliver to harvest, and corn, challenged by the drought conditions seen in recent harvest years.

Key Insights: Cereals in Europe – EU27

- $7.4 billion total market value in Europe, 81% proprietary and 19% saved seed

- 3% YoY market growth

- 12% of global seed volume is used in Europe, over 7% of the global cropping area

- In 2022, 82% of seed in the majority of Europe is purchased dressed, up from 70% in 2020

Politics, policy and producers

An interesting association from the survey showed the greater cultivated area of a country, the lower % use of certified seed. Despite this, Russia continues to dominate with seed value for wheat, four times that of second-placed Ukraine, and roughly ten times that of other wheat producing European countries such as the UK, Poland and Romania. Russia’s war with Ukraine has unsettled downstream supply and made policy makers sweat; but seed is still going in the ground.

Looking toward dairying and energy supply, silage and biogas all reduced overall in cropping area, as did maize grain, with growers in countries such as Spain, France and the UK shying away from corn following several years of dry weather, a notorious challenge for this thirsty crop. In contrast, Eastern Europe saw seed demand for silaging maize and biogas increased between 1 – 11% in Eastern Europe.

News

The latest from Kynetec